Be the Employer of Choice with MEWSS

By offering your employees a workplace savings plan through MEWSS, you can help foster loyalty and boost productivity.

Ask for a consultation

In Partnership with Praxis

50+ Years

managing trust products

trusted asset management firms

In financial services and regulated in the UAE by the FSRA

Is MEWSS the Right Solution

for My Company?

Attract Top Talent and Retain Employees

Financial Well-being for Employees

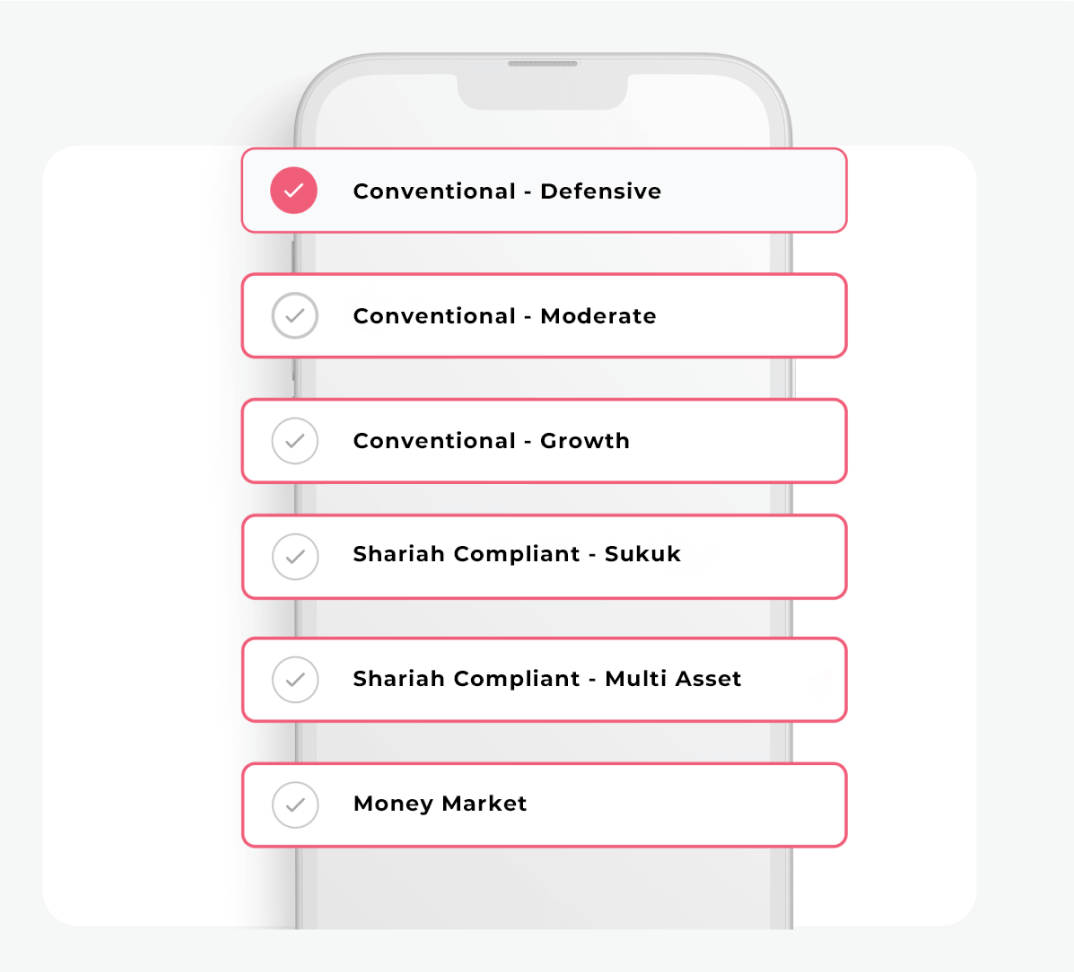

A Wide Range of Investment Options

Trusted and Backed with Top Security Measures

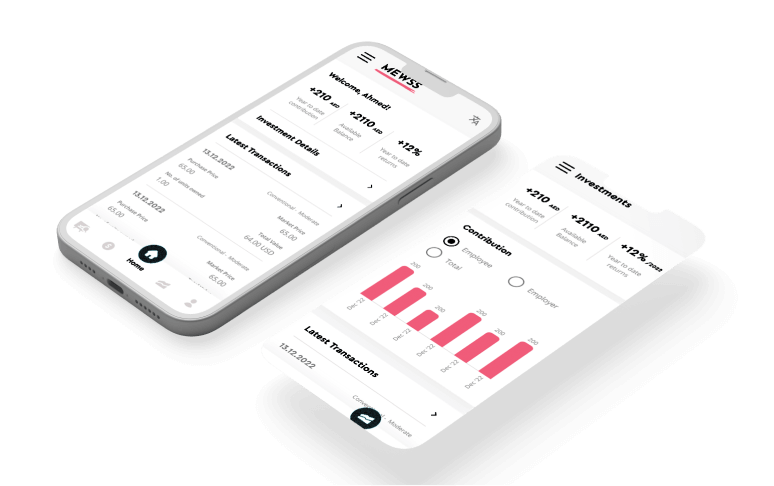

Easy Management

Affordable and Suitable for Businesses of all Sizes

BENEFITS

Win–Win Situation

Retaining Talent and Reducing Turnover

Retaining Talent and Reducing Turnover

Improving Employee Productivity

Improving Employee Productivity

Enhancing Employee Value Proposition

Enhancing Employee Value Proposition

Promoting Financial Well-being

Promoting Financial Well-being

Offering Control and Flexibility

Offering Control and Flexibility

Providing Equal Opportunity

Providing Equal Opportunity

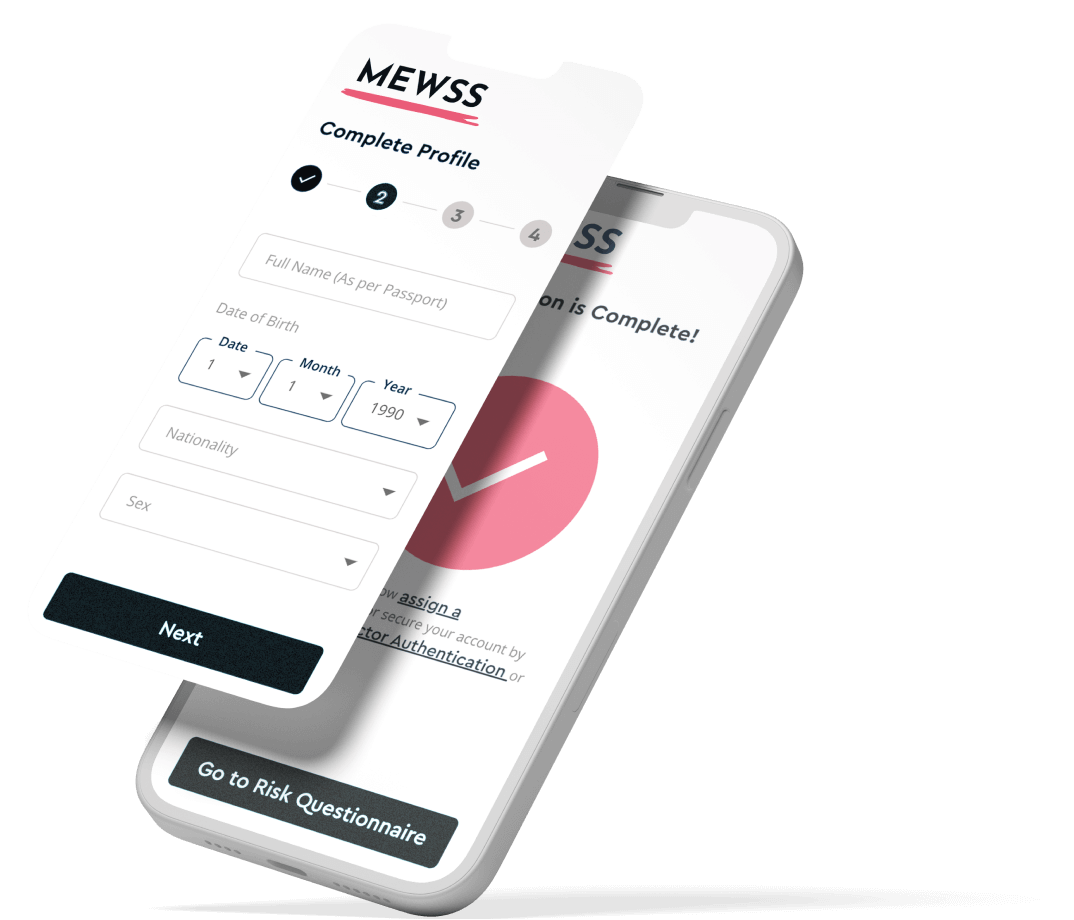

How to Get Started

with MEWSS in 3 Steps

Easily integrated with most HR Systems

Try It Yourself

Frequently Asked Questions

What is the Middle East Workplace Savings Solution (MEWSS)?

It seamlessly integrates with most HR systems, making it easy to support your employees' financial growth and security.

How does MEWSS benefit both employers and employees?

MEWSS empowers employers by enhancing employee financial well-being, which leads to higher retention and productivity. It also helps attract top talent and retain it by offering a valuable savings plan as part of your employee benefits.

For employees, MEWSS provides an easy way to build their financial future, reducing financial stress.

What makes MEWSS different from other savings plans?

- Investment Options: Employees’ savings are invested in globally diversified investment options.

- Trustee and Administration: The trustee of MEWSS is Praxis, which is regulated by the FSRA in ADGM, to handle the operations with the highest standards of care.

- Flexible and Accessible: No complex paperwork or high minimum requirements, making it accessible for all employees.

- Cost-Effective: Offers competitive fees, making it affordable for businesses of all sizes.

- Seamless Integration: Easily integrates with most existing HR and payroll systems, simplifying administration.

How do I get started with MEWSS for my company?

What kind of support does MEWSS offer for administration and management?

How does MEWSS help improve employee retention and productivity?

Are there any additional costs for using MEWSS?

How do I enroll in the MEWSS program?

What investment options are available through MEWSS?

Can I control my savings and withdraw funds when needed?

What are the benefits of using MEWSS?

How does MEWSS ensure the security of my contributions?

What kind of financial education and support does MEWSS provide?

Do employees have to contribute every month?

How can employees change their contribution amounts?

How do employees change their savings options?

What happens if employees stop contributing?

What happens when employees leave the company?

Can I contribute my own money to MEWSS?

Who manages and regulates the funds within MEWSS?

These funds are safeguarded by a regulated trustee who ensures that all transactions and holdings are handled securely and transparently, following strict regulatory standards.

Is MEWSS compliant with local financial regulations?

So, MEWSS adheres to the regulations that the above parties abide by.

What happens to an employee's savings if they leave the company?

What kind of customer support is available for MEWSS users?

How can I contact MEWSS for more information or assistance?

Contact us through our website or customer support for any assistance.

Are there any resources or guides available for new users?

We provide detailed guides and resources to help new users get started.